Partnerships and corporations may assist their partners and stakeholders on how to prepare their Schedule K1 tax form. And just like any other tax return, failure to comply will result in fines and penalties. The responsibility of filing this tax with the IRS form lies on the partnership (in the case of Schedule K1 Form 1065) or corporation (in the case of Schedule K-1 Form 1120S). This function makes K1 tax form serve as an information document the IRS must have a copy of.Īccountants or tax prepares must report this tax form to IRS on or before March 15. However, an accountant (or anyone who prepares your taxes) must get a copy of this tax form for the proper completion of a tax return.

Mostly, a partnership or corporation keeps the K1 tax form for an individual’s records purposes.

#WHAT IS A 1065 TAX FORM USED FOR CODE#

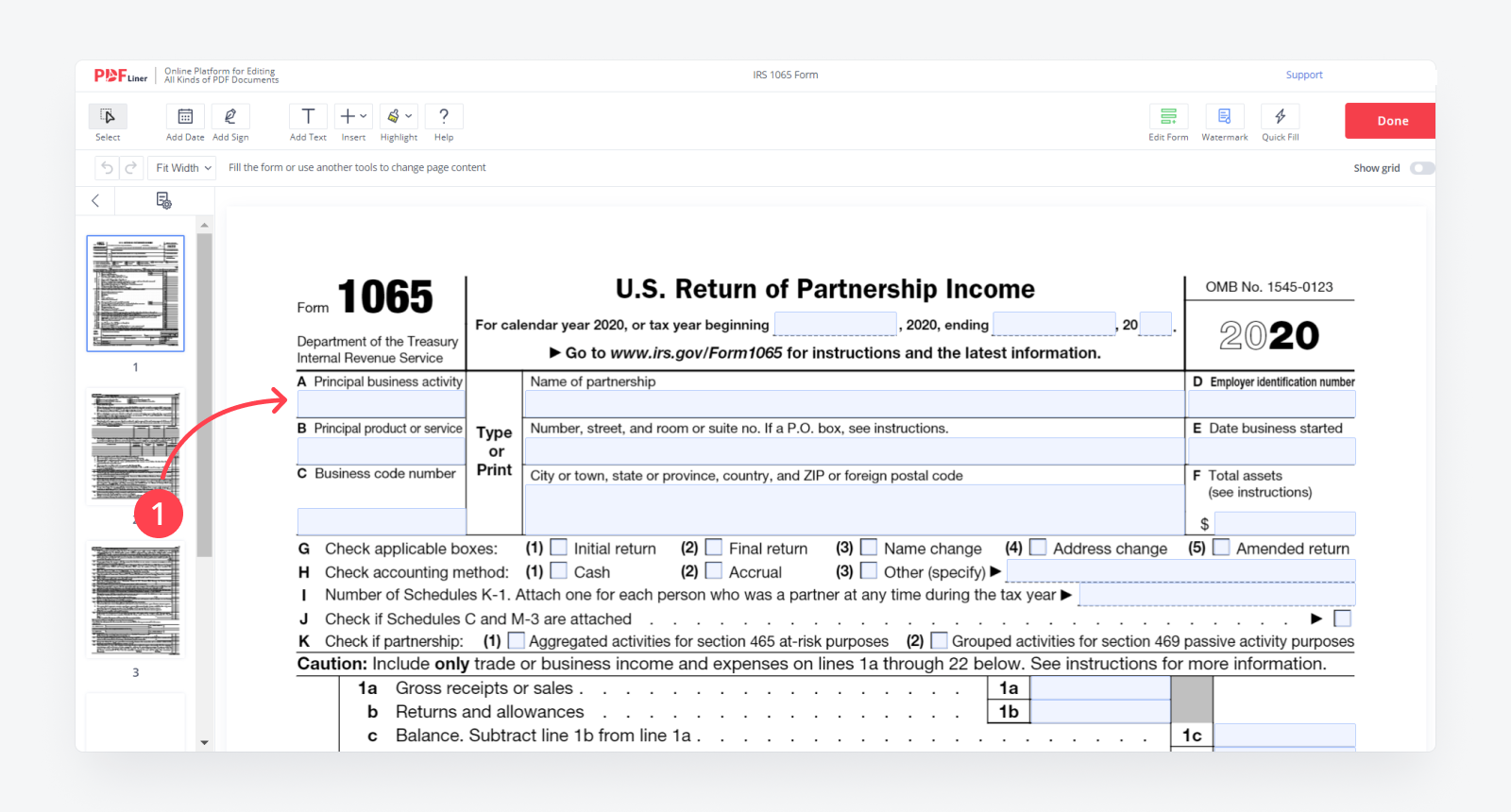

reporting of backup withholding required in box 13 using code O (for Schedule K1 Form 1065 and Schedule K1 Form 1120S).reporting of backup withholding required in box 13, code B (for Schedule K1 Form 1040).RELATED: How to Get Free Tax Help | Tax Relief Center Partners would complete the second page of Schedule E and not the first page, which is used for individual owners of rental property. The partners must also file Schedule E, Supplemental Income and Loss, along with their individual income tax returns IRS Form 1040. Schedule K1 Form 1120S is used to report one’s share of a corporation. A copy of Schedule K-1 must accompany a copy of IRS Form 1065. Income Tax Return for an S Corporation (Form 1120S).Schedule K1 Form 1065 is used to report one’s share of a partnership. Return of Partnership Income (Form 1065).Schedule K1 Form 1040 is used to report one’s share of an estate or trust. Individual Income Tax Return (Form 1040).This tax form constitutes Schedule K-1 of the following IRS Forms: What Are The Different Types of K1 Tax Form? For partnerships or corporations, the “pass-through” concept allows the equal division of benefits to each partner or shareholder. The need for K1 tax form is due to the concept of “pass-through taxation.” This is a concept in the US tax code which passes the obligation of paying taxes from the one who owns a business or an estate to those who actually benefit from the business (like a stakeholder or partner) or from an estate (like the heir to an estate).

0 kommentar(er)

0 kommentar(er)